Does Presidential Party Impact Inflation Estimates?

Post developed by Katie Brown and Cassandra Grafström.

So-called “inflation truthers” have made recent news waves with claims that inflation is actually much higher than reported. Mainstream financial news organizations have debunked the inflation truthers charges with the simple math of averages. But what if the truthers are just looking in the wrong place? That is, is there systematic bias not in reported inflation but projected inflation?

So-called “inflation truthers” have made recent news waves with claims that inflation is actually much higher than reported. Mainstream financial news organizations have debunked the inflation truthers charges with the simple math of averages. But what if the truthers are just looking in the wrong place? That is, is there systematic bias not in reported inflation but projected inflation?

Enter the work of Cassandra Grafström, a Ph.D. candidate in the Department of Political Science and affiliate of the Center for Political Studies (CPS) at the University of Michigan. Grafström, along with Christopher Gandrud of the Hertie School of Governance, conducted research to trace potential partisan biases of inflation estimates.

Grafström and Gandrud began with the widely accepted notion that under more liberal governments, the United States Federal Reserve tends to predict higher inflation. But why? Democratic administrations tend to try to lower unemployment, which causes higher inflation. Under more conservative governments, on the other hand, the Federal Reserve predicts lower inflation. Yet there exists little empirical support for these ideas. Instead, most work on inflation comes from the field of economics, with a focus on comparing Federal predictions with money market predictions.

To test these commonly held ideas, Grafström and Gandrud looked at the Federal Reserve’s predictions across time. The authors took Presidential party and actual monetary and fiscal policies into account. They found that, regardless of actual monetary and fiscal policies, under more liberal presidents, the Federal Reserve over-estimates inflation while under more conservative presidents, the Federal Reserve under-estimates inflation.

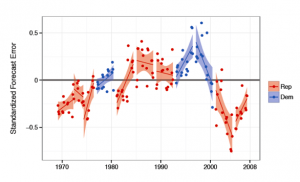

In the graph below, perfect predictions would create an error of 0. Points above the line correspond to over-estimation and points below the line correspond to under-estimation. As we can see, when a Democrat is president, estimate errors tend to be above the line, while the average of Republican errors falls below the line.

Errors in Inflation Forecasts Across Time by Presidential Party

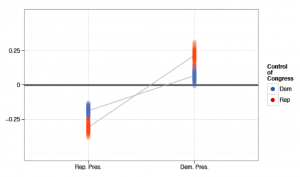

Grafström and Gandrud also wondered if control of Congress plays a role. To test this, they considered the joint influence of presidential party and the majority party in Congress. As the graph below shows, presidential party drives the trend. Interestingly, a Republican controlled Congress makes the original results stronger. That is, with a Democratic president and Republican congress, there is greater over-estimation of inflation. Likewise, with a Republican president and Republican congress, there is greater under-estimation of inflation. The graph below illustrates these findings (0 would again represent a match between predicted and actual inflation)

Errors in Inflation Forecasts Across Time by Presidential and Congress Majority Parties

Given the clear links between presidential partisanship and inflation forecasts, the authors worry that this likely translates into biased monetary and fiscal policies. That is, over-estimated inflation under Democratic presidents may lead to more restrictive monetary and fiscal policies. On the other hand, under-estimated inflation under Republican presidents may lead to more expansive monetary and fiscal policies. In both cases, the policy changes would be based on forecasts biased by flawed but accepted rules of thumb about inflation under Democrat vs. Republican presidents.